Banking, Financial Services & Insurance (BFSI)

Essential intelligence for BFSI professionals covering critical financial risk and regulatory compliance. The BFSI Stage at #RISK Expo Europe provides deep-dives into combating high-priority financial crime areas like Anti-Money Laundering (AML), Sanctions Evasion, and sophisticated Fraud schemes.

#RISK Intelligence - Latest from BFSI Stage

- Opinion

Does business need to start training for a Hunger Games world?

As global rules fragment and power politics increasingly override legal certainty, businesses face a radically altered risk landscape where geopolitics directly shapes commercial outcomes.

- News

#RISK Expo Europe 2026 is an open, inclusive, community first expo

Breaking down barriers to entry for the global GRC community, #RISK Expo Europe 2026 returns to Excel London on 10 & 11 November. This open, free-to-attend event provides a unique space where practitioners, regulators, and innovators engage on equal terms. Featuring 300+ expert speakers across multiple themed stages and AI-focused workshops, #RISK Expo Europe is the essential gathering point for CEOs, CROs, and CISOs seeking a collaborative, inclusive approach to organisational resilience and integrated risk strategy.

- News

BFSI Risk Agenda: Operational Resilience, Financial Crime & Climate Risk Lead the Discussion at #RISK Expo Europe 2026

As the UK remains a premier global financial centre, the BFSI sector faces continuous pressure from macroeconomic volatility, sustainability shifts, and evolving regulations. The BFSI Stage at #RISK Expo Europe 2026 is the cornerstone for senior leaders; including CROs, CCOs, and CISOs, seeking expert insight on critical areas like Operational Resilience, Financial Crime & Fraud, Third Party Risk, and Climate Risk Stress Testing. Discover how to navigate regulatory change and fortify your enterprise against the sector’s most urgent threats.

- News

#RISK Expo Europe 2026 established and still scaling

By year five, repeat attendance, word‑of‑mouth and brand familiarity typically start to play a larger role than launch marketing but we’re not relaxing.

Banking, Financial Services & Insurance (BFSI)

#RISK Expo Europe 2026 established and still scaling

By year five, repeat attendance, word‑of‑mouth and brand familiarity typically start to play a larger role than launch marketing but we’re not relaxing.

- Previous

- Next

- News

Beyond GRC: #RISK Expo Europe 2026 Adds Five Critical New Categories to Meet Evolving Risk Demands

In direct response to feedback from senior decision-makers, the 2026 programme will now feature dedicated streams for Identity & Access Management, Operational Resilience & Business Continuity, Procurement Risk & Supplier Governance, Physical Security & Asset Protection, and Crisis Management & Incident Response, expanding coverage beyond traditional GRC.

- Feature

Is Your Job Title Bigger Than Your Job Description?

Your title might be Head of Cyber, GRC, or Privacy, but the reality of 2025 is that your real job is now much bigger. In an era of interconnected risk, the most effective leaders are those operating far beyond their official remit.

- News

#RISK Europe Expands its Community with New Partnerships in Professional Development, Finance, and Startup Innovation

As Europe’s leading risk expo continues to build momentum, it announces four new strategic partnerships with The CPD Group, Enterprise Risk Management Academy (ERMA), Financial Services Review Europe, and Startupmag, further strengthening its commitment to professional excellence and a diverse, cross-functional community.

- Feature

Mastering the Interconnected World: Why the Five Critical Risks of 2025 Demand a New Approach

As leaders grapple with a landscape defined by AI disruption, geopolitical volatility, and hyper-connectivity, the siloed approach to risk management is no longer viable. #RISK Europe is designed to address this new reality head-on.

- News

#RISK Europe Builds Unrivaled Expertise Across Core Pillars with New Wave of Strategic Partnerships

With momentum accelerating towards Europe’s premier risk expo, a second wave of influential partners, including the Institute of Risk Management and Innovate Finance, reinforces the event’s core focus on GRC, Risk, AI, and Cyber GRC.

- News

#RISK New York Goes LIVE Today! Your Journey into the Future of GRC Begins Now!

The wait is over! #RISK New York officially opens its doors today, Wednesday, July 9th, promising an unparalleled deep dive into the most critical challenges and opportunities in Governance, Risk, and Compliance.

- Feature

AI vs. AI: Winning the Race Against Financial Crime in the Real-Time Era

The financial services industry is undergoing a profound transformation, accelerated by the power of Artificial Intelligence (AI).

- Feature

Trump’s Regulatory Impact: Prepare Your 2025 Compliance Strategy

The North American regulatory landscape is in a state of constant evolution, driven by factors ranging from political transitions and economic pressures to technological advancements and heightened public scrutiny.

- News

#RISK London Day 1: A Resounding Success

The first day of #RISK London, the UK’s premier risk focused conference, brought together thousands of professionals from the fields of governance, risk, compliance, privacy, security, RegTech, and AI for insightful discussions, networking opportunities, and expert presentations.

- News

Financial Services Review Partners with Risk London: Navigating the Evolving Risk Landscape

The financial services industry is the lifeblood of a thriving economy. It facilitates vital transactions, fuels innovation, and underpins growth. However, this complex landscape is also inherently risky. Fraud, cyber threats, regulatory changes, and market volatility are just some of the challenges institutions face.

- News

Introducing #RISK London Partners, the International Compliance Association (ICA)

The International Compliance Association (ICA), a leading professional body for regulatory and financial crime compliance, and #Risk London, the UK’s premier event for governance, risk, and compliance (GRC) professionals, are thrilled to announce the partnership.

- Webinar

Navigating DORA: Preparing for Europe’s New Operational Resilience Regulation

Webinar produced by GRC World Forums in association with Resolver

- Webinar

Navigating DORA: Preparing for Europe’s New Operational Resilience Regulation

Webinar produced by GRC World Forums in association with Resolver

- Webinar

How Financial Services Companies Can Protect Themselves Against Financial Crime

Webinar produced by GRC World Forums in association with Exterro

- News

High-profile German Banker on trial for fraud

In a headline-grabbing trial taking place this week in Bonn, a top German banker, Christian Olearius, is facing accusations of involvement in a vast multibillion-euro tax fraud scheme known as “cum-ex” or dividend stripping.

- News

Regulators will remain tough on financial crime despite global fall in violations

Regulators worldwide issued 97 fines related to financial crimes during this period, totalling $189 million. The downtick represents an 88 percent decrease from the previous year. Experts argue that this decline might be attributed to pandemic-related investigation backlogs and a heightened focus on strict compliance standards by financial firms.

- News

ID theft fraud up by almost 100% through 2022

Throughout last year, levels of ID theft almost doubled in the UK, according to new research.

- News

ID theft hits USA’s southern states most through 2022

New research has revealed that citizens in the southern states of the US suffered most from ID theft in 2022 compared with the rest of the country, with millennials most likely to be the victims.

- Webinar

How Financial Services Companies Can Protect Themselves Against Financial Crime

Webinar produced by GRC World Forums in association with Exterro

- News

Social media user data available for as little as $6 on Dark Web

A recent study has uncovered a thriving market for hacked social media and entertainment service accounts on the Dark Web, with accounts available for purchase to users for as little as $6USD each.

- News

Survey lists US identity theft hotspots

Rhode Island has been identified as the worst state in the U.S. for identity theft, according to a recent study.

- News

EBRD and ACAMS work to enhance anti-financial crime training in Middle East and North Africa

In an effort to bolster anti-money laundering (AML) and sanctions compliance efforts, the European Bank for Reconstruction and Development (EBRD) and the Association of Certified Anti-Money Laundering Specialists (ACAMS) have partnered to provide more robust training programs in Egypt, Jordan, Lebanon, Morocco, Tunisia, the West Bank, and Gaza.

- Webinar

Investigating Financial Crime and Fraud: Technology Showcase

Conducting investigations involving financial crimes such as fraud, money laundering, political corruption, insider trading or cybercrime, can be very complex.

- Webinar

The Role of Disclosures in Risk Assessment and Management

Conflicts of interest (COI) management is an integral element of ethics and compliance programs.

- Webinar

After the attack: There’s No Place for Guesswork in Cyber Attack Investigations (MEA Region)

Investigations are multiplying and diversifying – there are more of them, the data volumes are bigger, and the outspread is wider.

- Event

FinCrime: Regional Focus with Exterro

FinCrime: Regional Focus with Exterro is a one-day livestream event, taking place on 24th November 2022, which will untangle the global financial crime landscape, focusing in on seven key regions.

- Sponsored

Apricorn — Blurred Boundaries: The ‘Consumer’ Scams That Could Be the Next Business Threats

Jon Fielding, Managing Director EMEA, Apricorn

- Feature

5 Takeaways From the Basel AML Index 2022: ‘Depressingly Little’ Progress, But Some Grounds for Optimism

The Basel Institute on Governance released its 11th annual Basel AML Index on Tuesday, and the report presents a mixed picture of global attempts to tackle money laundering.

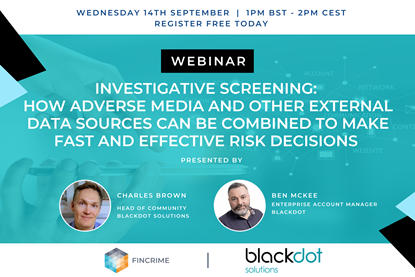

- Webinar

Investigative screening: How adverse media and other external data sources can be combined to make fast and effective risk decisions

Recent events have encouraged financial institutions and their regulators to pay closer attention to the role of adverse media (also known as negative news) screening in AFC risk management. But adverse media screening alone is not a panacea, and there are a range of other external data sources that can be leveraged to improve the process of alert resolution.

- Webinar

Conducting Investigations in a Zero-Trust Environment

Every day, organisations are faced with insider and outsider threats. Because of that, the Zero-Trust security approach is quickly becoming the standard for both corporations and Government agencies.