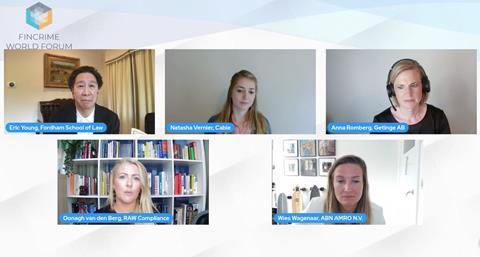

Subject-matter experts came together today at FinCrime World Forum to study the key issues around ongoing cultural challenges for the financial services sector.

In an exclusive debate, “Cultural Capital – Can we achieve a positive FinCrime compliance culture”, panellists also questioned whether incentives faced by staff are too contradictory to make positive compliance culture a realistic possibility.

In recent years, there has been an increasing number of cases highlighting the failures of senior staff to take FinCrime issues seriously, or support whistleblowing when internal suspicions arose. Some critics have thus suggested that the talk of ‘compliance culture’ from large institutions – well able to afford to pay fines for failure – has in fact been purely rhetorical.

The session was hosted by Oonagh van den Berg, CEO & Founder and Managing Director, RAW Compliance and Virtual Risk Solutions.

Eric Young, CEO – Young Enterprises LLC and former CCO – BNP Paribas Americas, Young Enterprises LLC, said:

“Oftentimes, regulations are a step behind the reality of what’s going on in institutions. How are we being compliant? In the US there’s not enough accountability. There are a lot of institutions that can afford to pay fines without changing behaviours.

“Without clear roles and responsibilities, we’re going to continue to have broken promises and a lack of accountability. In the US there aren’t enough incentives for management to take on new technologies. There’s no consequence, no technology and so things aren’t going to change.

”A strategy for change has to be long-term. To start making positive shift, we need to hold management more accountable and make them more long-term focussed.”

Anna Romberg, EVP Legal, Compliance & Governance Getinge AB and Co-Founder Nordic Business Ethics, said:

To make positive change, organisations must have an honest look at culture, the behavours and what’s happening at all levels and allow yourself to be very critical. You’ll be very surprised by what you find.

Wies Wagenaar, Head of Compliance: Conduct & Ethics, ABN Amro Bank N.V, said:

“Behaviour must be seen as a result, not a cost. We need to move more to being fully compliant and having our foundations right, but we shouldn’t talk about it as a bottom-line regulatory fulfilment of what needs to be done. We need to consider it as an ethical element, and focus on doing the right thing.

“We need to hold more people to account, but I also think that there should be consequences. We need to look at things that are done well and build in positive consequences to enhance compliance culture.

“Shareholders can play a great role in this, if they’re not fully focussed on profit all the time.”

Natasha Vernier, Co-founder and CEO, Cable, said:

“Real change needs to come from technological and regulatory innovation. At the moment, when customers are onboarded, people are aware that very few tasks worked may be reviewed. If they make a mistake there’s a very low chance that that mistake will be picked up.

“If we can use tech to change how we think about how financial crime is done and tested and assured, then we can move to a positive incentive culture, where it’s not a fine or a sanction for getting something wrong, but it’s a positive outcome for doing something right.

“If shareholders are going to hold banks to account, they need to know what’s going on about financial crime. We need to do more to increase widespread education among stakeholders.

“To make a positive change, organisations should use technology in new and innovative ways so they can understand how effective their controls are through all areas of business. This will focus attention on where it needs to go.”

No comments yet