We can reveal that fincrime and legal specialist Jane Jee will be among speakers at #RISK Digital.

Streaming live January 24 and 25, #RISK Digital gives global audiences the chance to improve understanding about how to mitigate risks, reduce compliance breaches and improve business performance.

Jane Jee is Lead for the Financial Crime Project at Payments Association, and regularly speaks on anti-money laundering as it affects financial institutions and other regulated entities. She will be appearing at exclusively at #RISK Digital to discuss the impact of emerging technologies on risk management.

→ Hear more from Jane Jee in her panel debate: “Data and Financial Crime: The Impact of Emerging Technologies on Risk Management”.

Time: 16:00 – 16:45 GMT | Date: Tuesday 24th January 2023

We caught up with Jane for details on her professional journey, and for insight into the issues addressed in her forthcoming panel debate at #RISK Digital.

Could you briefly outline your career pathway so far?

I trained as a barrister and spent nine years at Ford, ending within Ford Credit as a Legal Adviser. I moved into credit cards and became Managing Director at Access with 12 million cards in circulation.

I stayed in payments (as opposed to moving into banking) and moved to Mondex International – an e-money company – and then to various Payment Gateway firms (WorldPay and Trust Payments) and a pre-paid card firm (Ixaris). I held both legal and commercial roles (Sales and Marketing). For the past eight years I have worked in the tech sector, driving technology to improve Compliance and prevent Financial Crime – Geoswift, Bryan Cave Kompli-Global and Numitor. Firms that offer these technologies are called “RegTechs”.

I have mainly concentrated on Know Your Customer (KYC), screening and Anti-Money Laundering (AML) monitoring and investigations. These are the key controls to prevent financial institutions from being misused for financial crime.

Despite the evolution of these processes in the past decade, their effectiveness and efficiency often remains an issue. Whilst individuals and organisations moved to digital and interconnected solutions, financial crime operations have remained reliant on outdated legacy systems and controls.

Customers want seamless frictionless global payment services. Financial Institutions (FIs) are finding it particularly challenging to meet customers’ heightened expectations due to manual processes and legacy technologies that no longer keep pace with the huge volumes of data being produced and the complexity of the global banking environment.

Could you outline emerging technologies or tech trends that are having the greatest impact on financial crime risk management today?

With huge amounts of data flowing in and out of banking systems, it’s impossible for humans to keep pace with demand. Risk alert backlogs are often growing faster than operations teams can handle.

Advanced data and analytics techniques such as artificial intelligence, machine learning, natural language processing and cognitive automation can be used to accelerate or automate a significant portion of the labour-intensive work, reducing operational costs and leaving people free to concentrate on exercising their judgement and making preventative interventions.

Artificial Intelligence

(AI) enables machines to learn and AI can reveal insights that traditional statistical analysis cannot. For example, see Graham Barrow’s LinkedIn posts for the way Risk Alert 247 can analyse Companies House data.

AI in Banking

AI’s ability to spot patterns and predict outcomes make it indispensable for risk management in the banking sector. AI risk management allows banks to better understand and mitigate risk more effectively.

AI technologies allow banks to assess a vast number of data points and quickly realize insights that help them protect against losses and boost ROI for their customers. Leveraging large, complex data sets, banks can develop risk models that are more accurate than those based on standard statistical analysis.

Real-Time Data Access from the World Economic Forum

From global businesses to individual consumers, we have all come to rely on real-time information. “Modern data”, or immediately available information about everything from credit card fraud to taxi availability, empowers businesses, users and consumers to make fast, informed decisions. Poor data can cause huge inconveniences, and even cost lives.

Real-time information is at a critical juncture, with the potential to be used in a variety of high-impact ways beyond simple day-to-day applications, including telecommunications, healthcare, data privacy, accessibility and especially preventing financial crime.

Graph Analytics

Graph analytics can be an essential tool in the fight against financial crimes. Graph databases enable data points to connect with one another in different ways than relational databases, making them better at discovering relationships between data points that might not be discoverable, or would take significantly more time and effort to discover, in a relational database.

In graph databases, data points are able to connect to multiple data points simultaneously. In relational databases, meanwhile, data points are only able to connect with each other one data point at a time. Graph databases, therefore, are better at revealing entire networks of connections. Social media networks such as Facebook and LinkedIn, for example, use graph databases to find connections between people. And another use case, of course, is detecting financial crimes.

Could you identify data and tech-based strategies that organisations are putting together to optimise the management of financial crime risk?

Regulators are asking more searching questions and imposing more and higher fines for AML failures. New requirements are continually being imposed and new technologies have become vital to enable FIs to be meet them.

FIs want to properly risk assess customers and not onboard those with many red flags. This means getting access to relevant up-to-date data before customers are onboarded and using technology to identify anomalies in transactions and behaviours which are out of line with normal patterns for that type of customer.

FIs are increasingly using network analytics (i.e. the application of big data principles and tools to the data used to manage and secure data networks) and anomaly detection tools. For example, these tools can identify potential collusion between parties in a trade transaction.

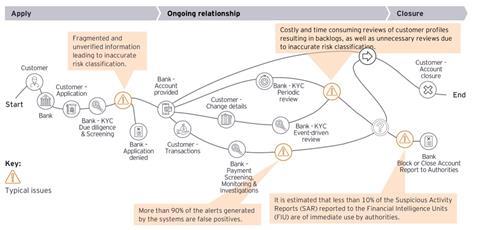

The visual below illustrates the key controls maintained by financial institutions throughout the customer journey to prevent financial crime and the typical issues impacting their performance:

Hear more from Jane Jee in her panel debate: “Data and Financial Crime: The Impact of Emerging Technologies on Risk Management”.

The session sits within a two-day agenda of insight and guidance at #RISK Digital, a risk-focused livestream experience taking place on January 24 and 25.

The event unites thought leaders and subject matter experts for a deep-dive into organisational approaches to handling risk. Content is delivered through keynotes, presentations and panel discussions.

- Session: (Stream 1) “Data and Financial Crime: The Impact of Emerging Technologies on Risk Management”

- Time: 16:00 – 16:45 GMT

- Date: Tuesday 24th January 2023

#RISK Digital is also available on-demand for global viewing

No comments yet